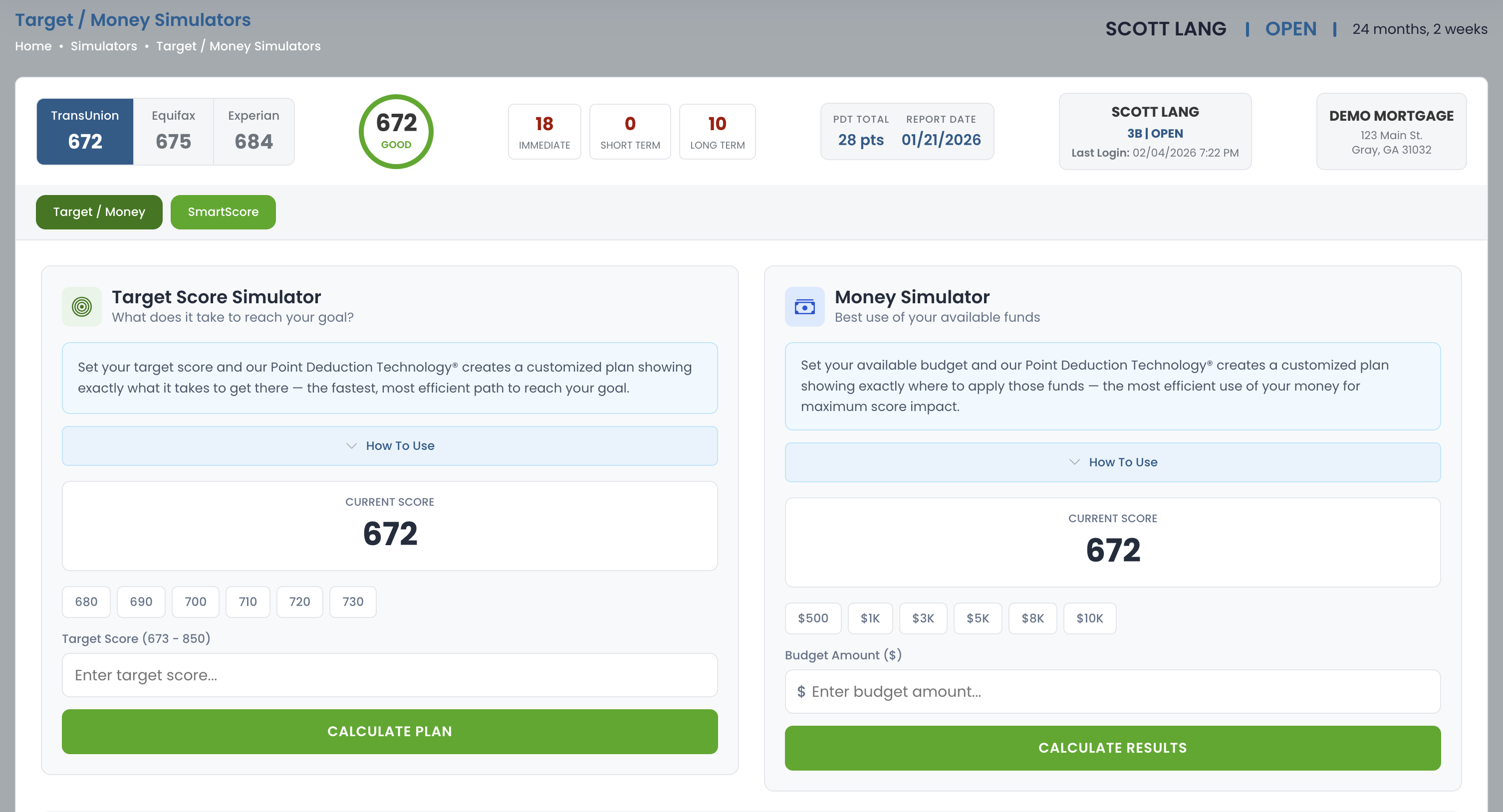

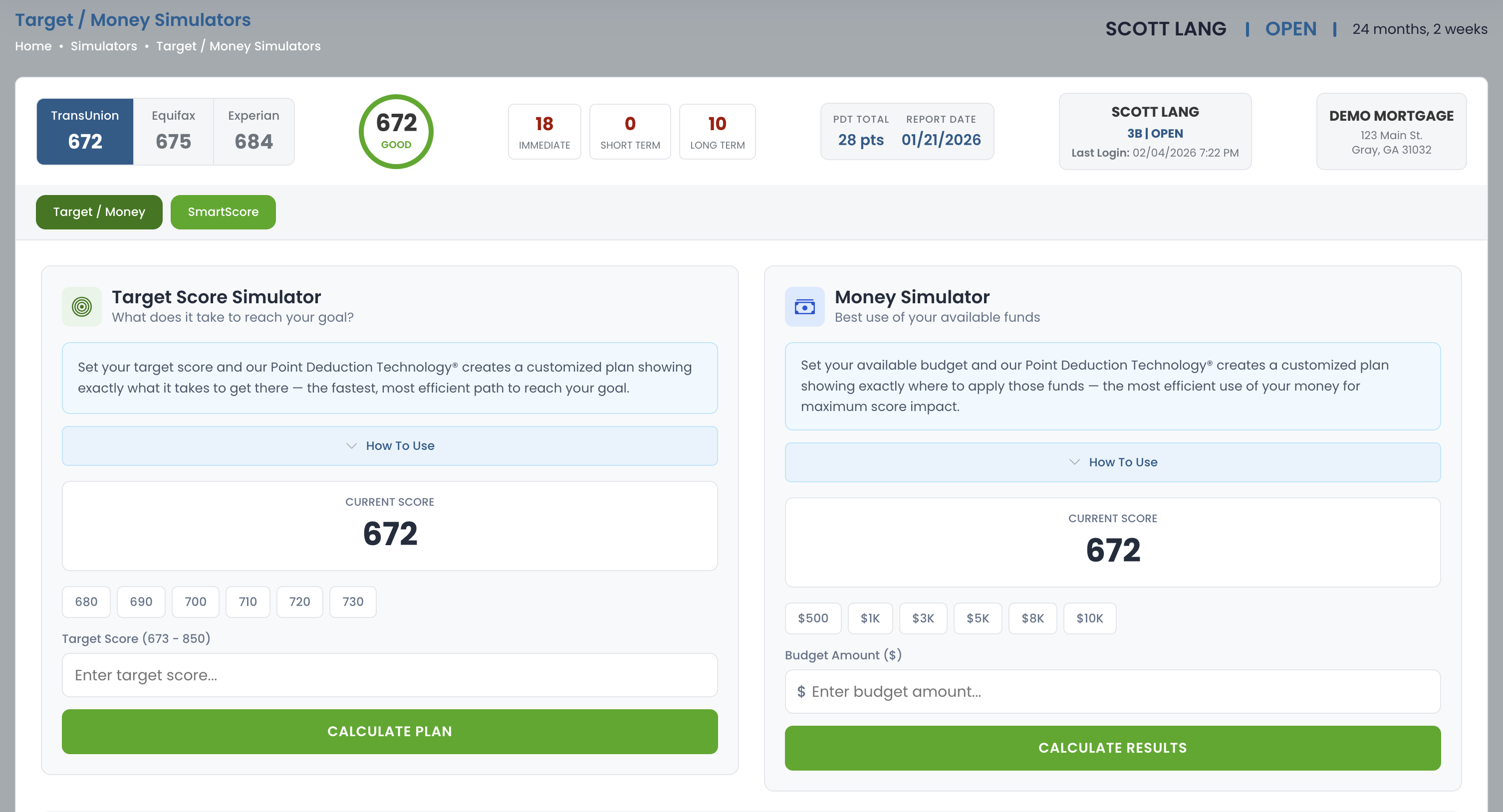

See exactly what actions will impact your score before you take them. Our simulators use your real credit data to show you the fastest path to your goals.

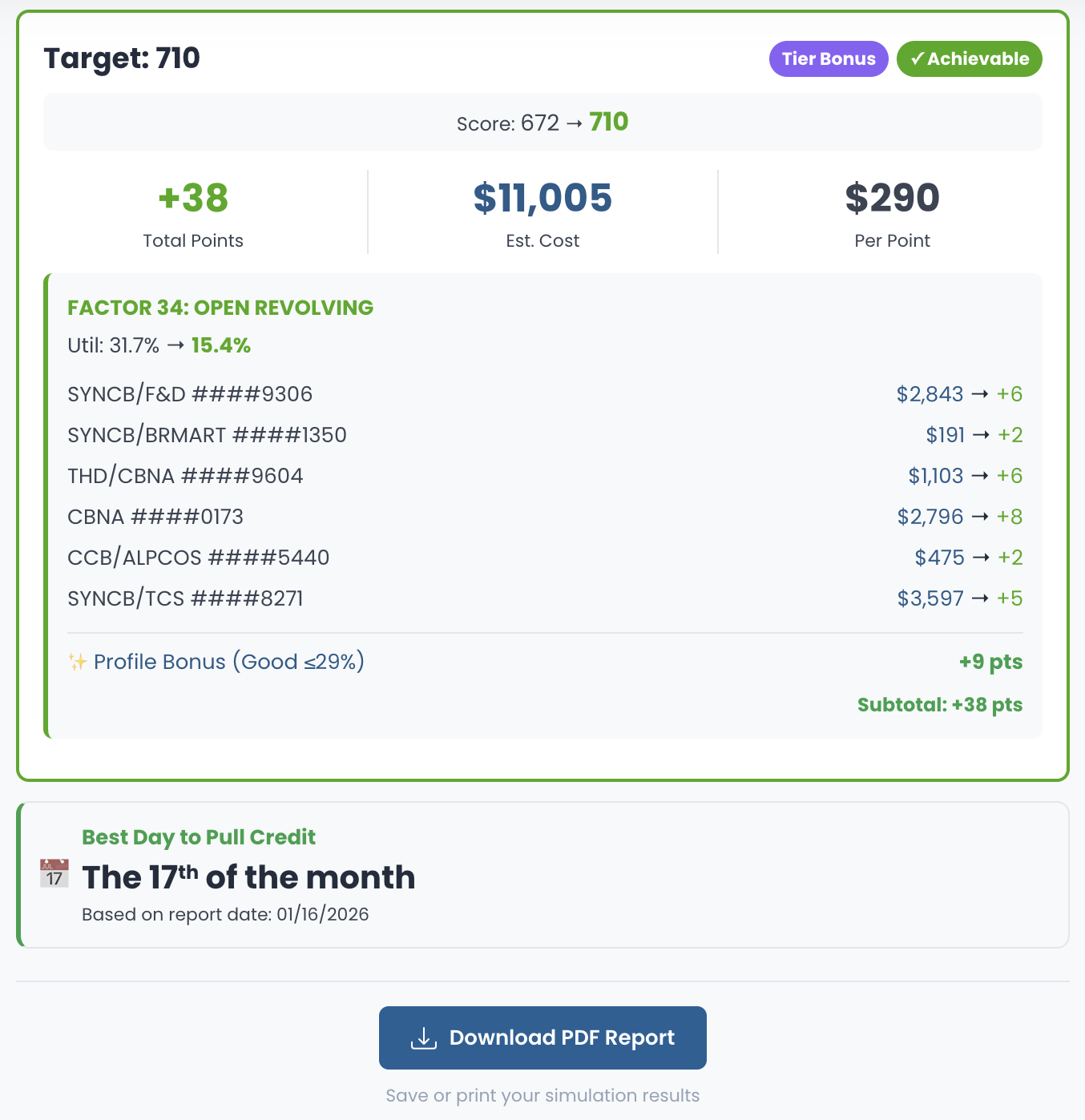

Set your target score and let our simulator show you exactly what actions to take. Perfect for mortgage qualification or any credit goal.

Tell us your goal score and we'll analyze your entire credit profile to create a personalized action plan. See exactly which accounts to pay down and by how much.

Enter your desired score and available funds. The simulator calculates the optimal strategy to reach your goal.

Generate detailed reports showing your action plan. Perfect for sharing with loan officers or keeping for your records.

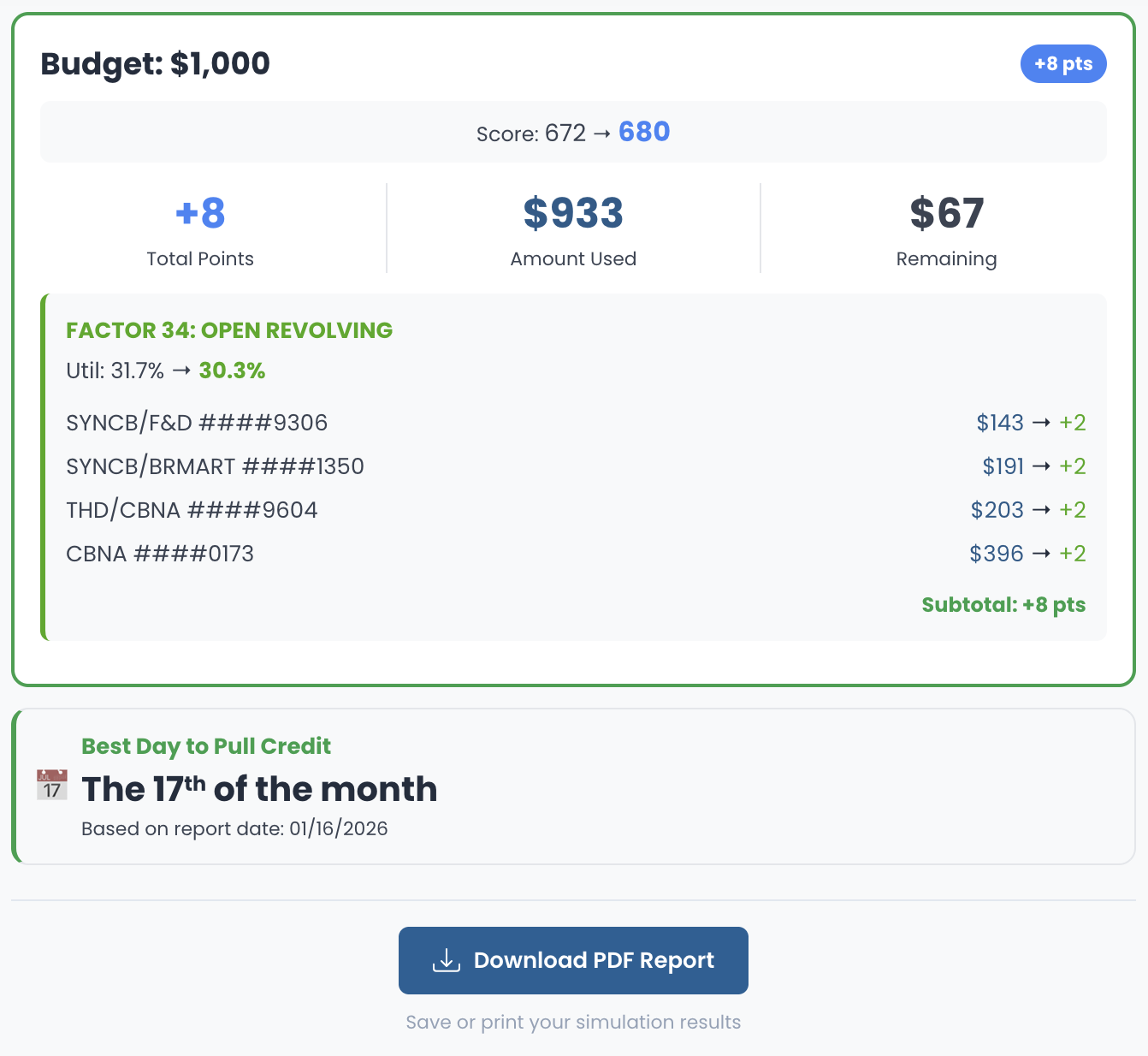

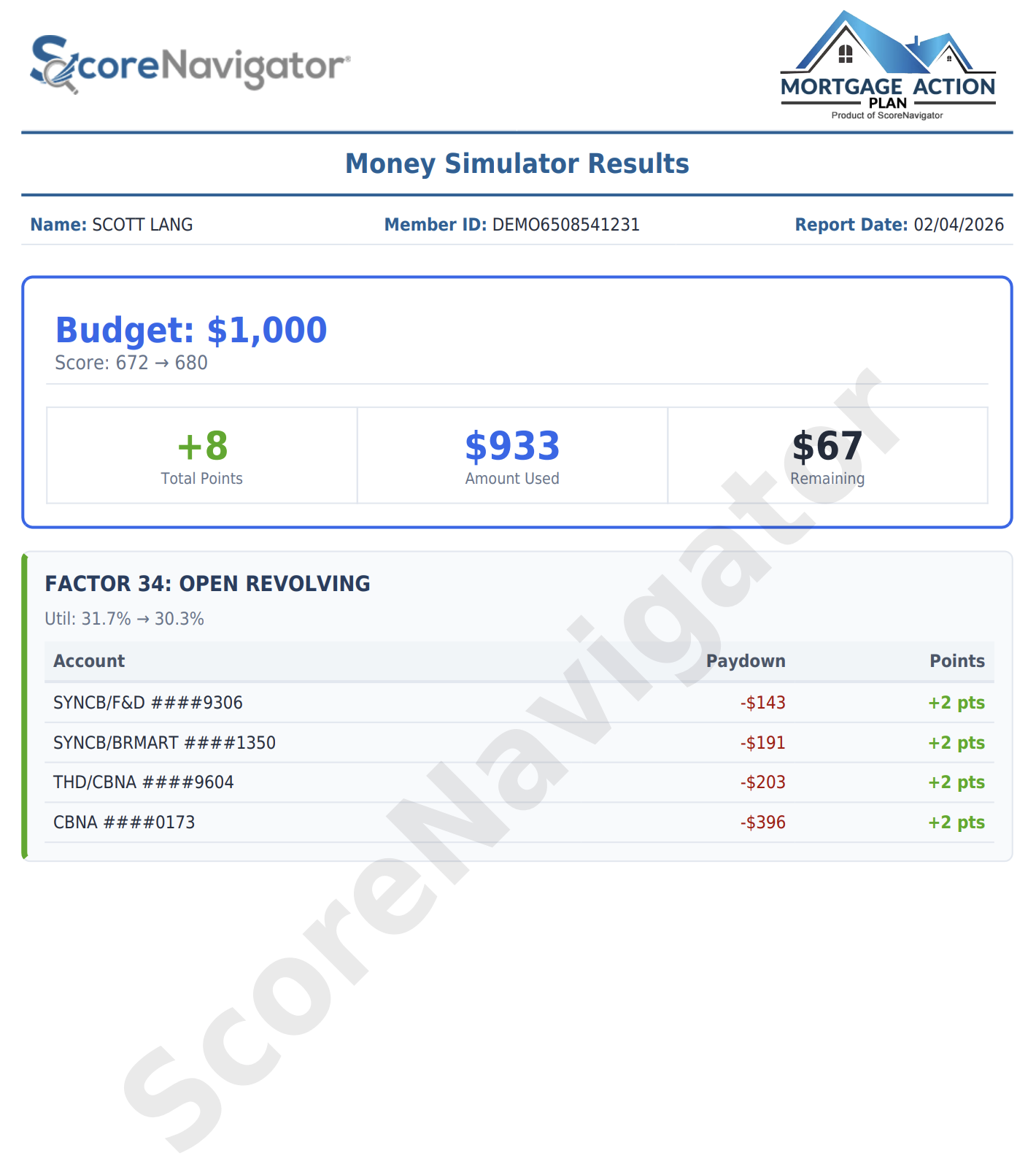

Got a specific budget? Tell us how much you can spend and we'll show you how to maximize your score with your available funds.

When you have limited funds, every dollar counts. The Money Simulator analyzes all your accounts to find the highest-impact payments within your budget.

Simply enter how much you have available to spend on credit optimization and let the simulator do the math.

Export a complete breakdown showing exactly which accounts to pay and by how much for maximum impact.

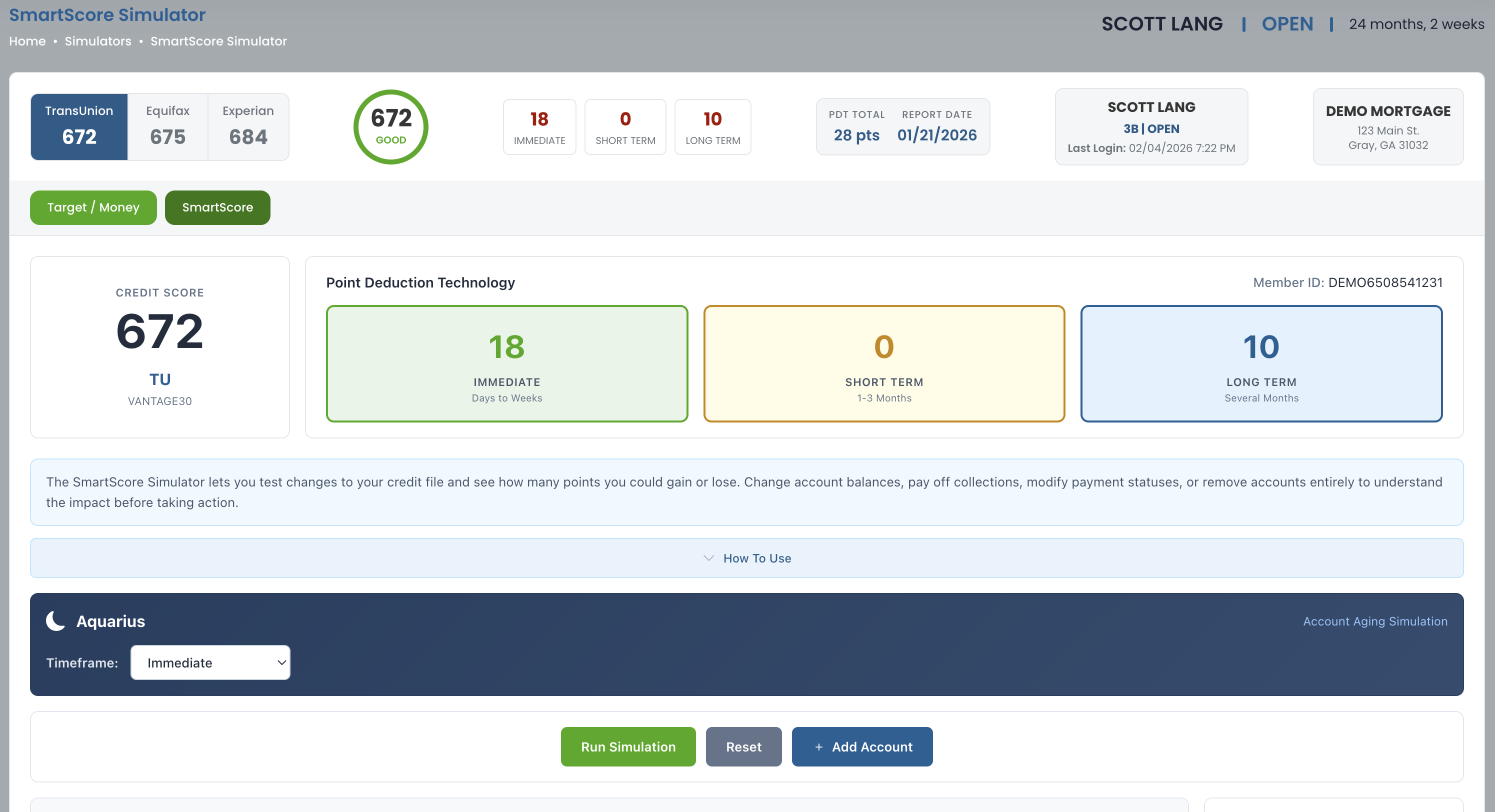

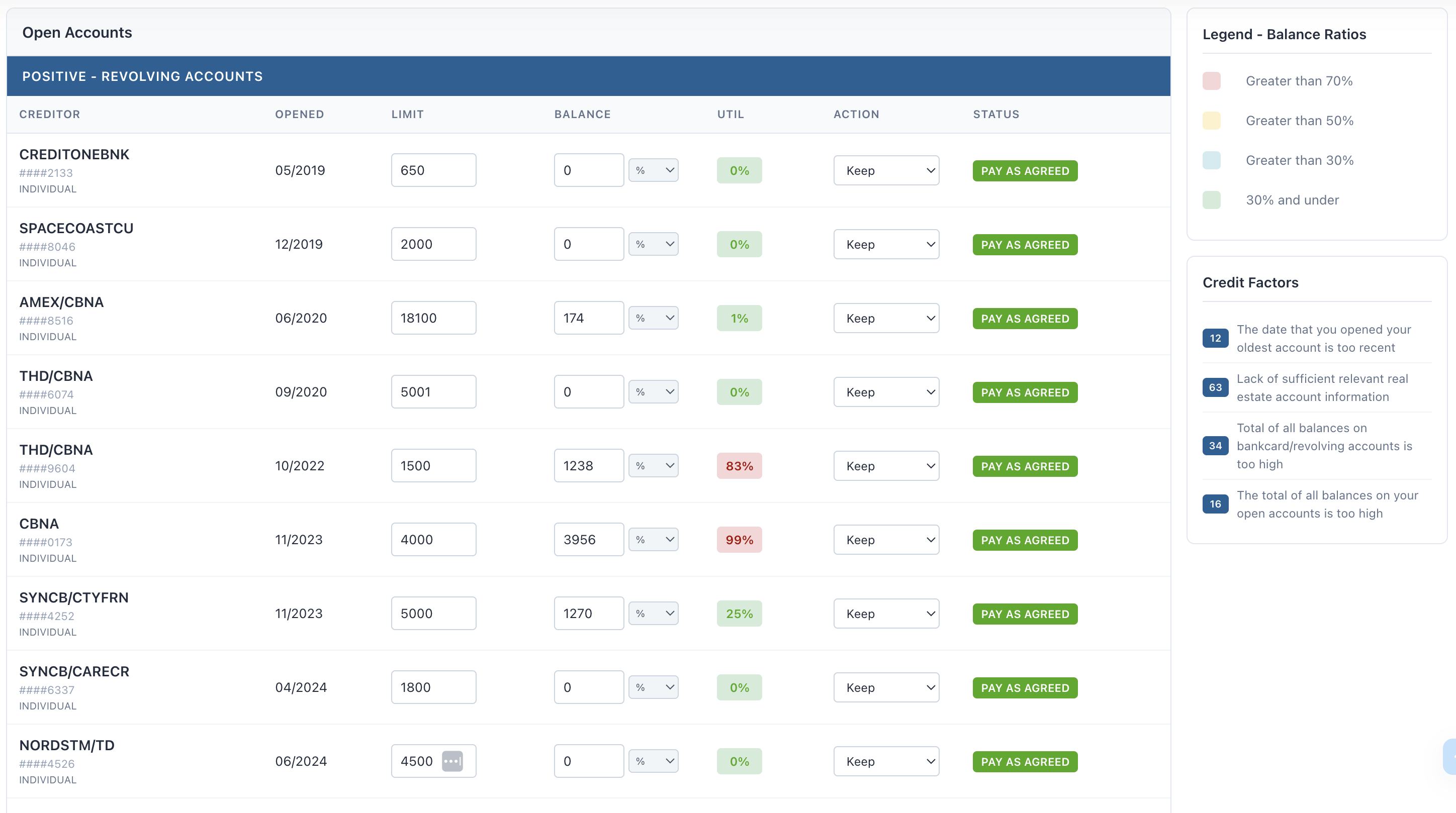

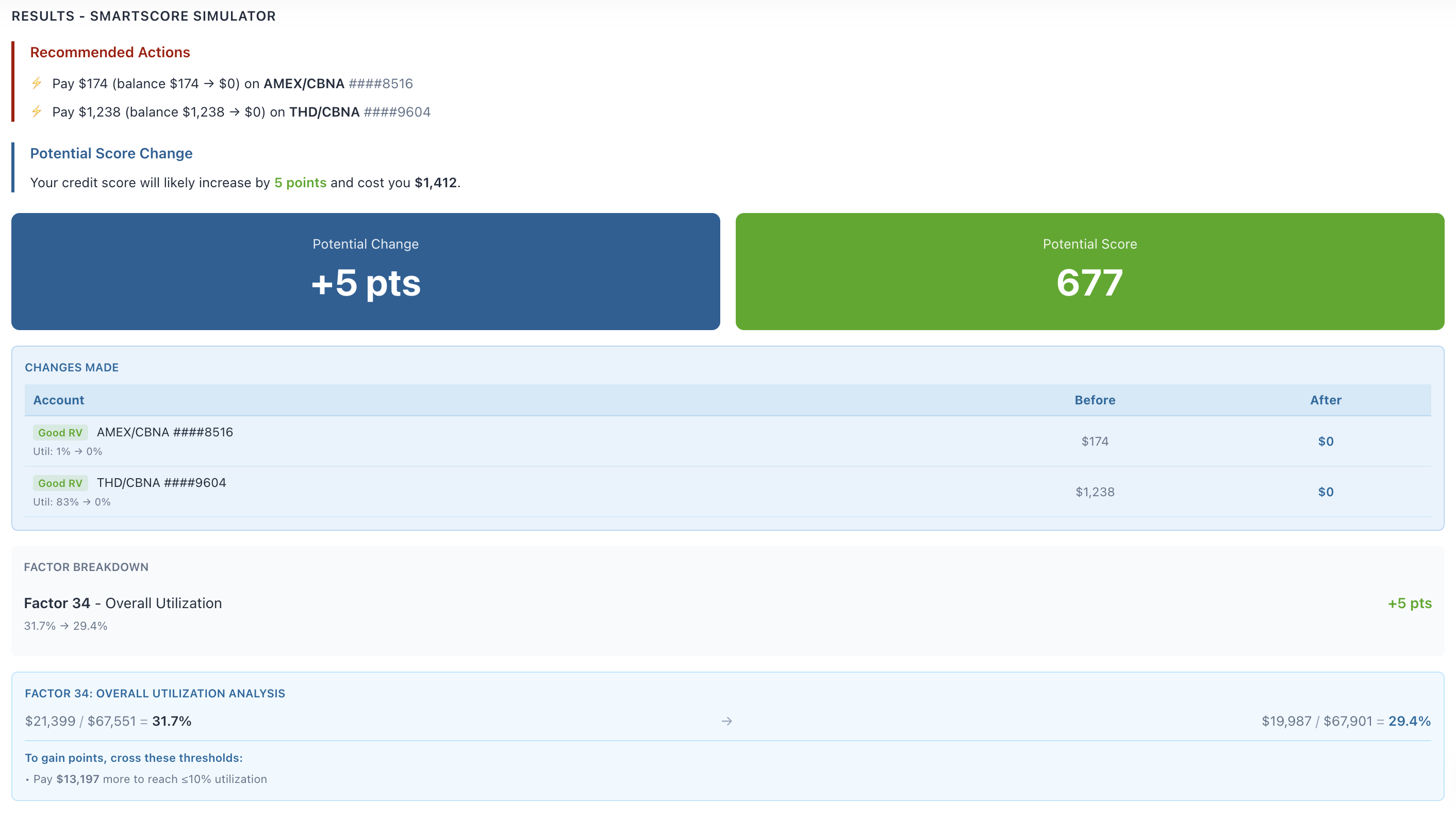

Our most advanced simulator. Test any "what-if" scenario and see how different actions affect your score before you commit.

Wonder what happens if you pay off a card? Open a new account? Close an old one? SmartScore lets you simulate any action and see the projected impact instantly.

Select from a comprehensive list of credit actions - pay down balances, open accounts, dispute items, and more.

See your projected score across all three bureaus instantly. Compare your current score vs. simulated score.

Get unlimited access to all three simulators plus credit monitoring, financial tools, and personalized action plans.