Get a personalized roadmap to mortgage-ready credit. See exactly what's affecting your score and the fastest path to qualification.

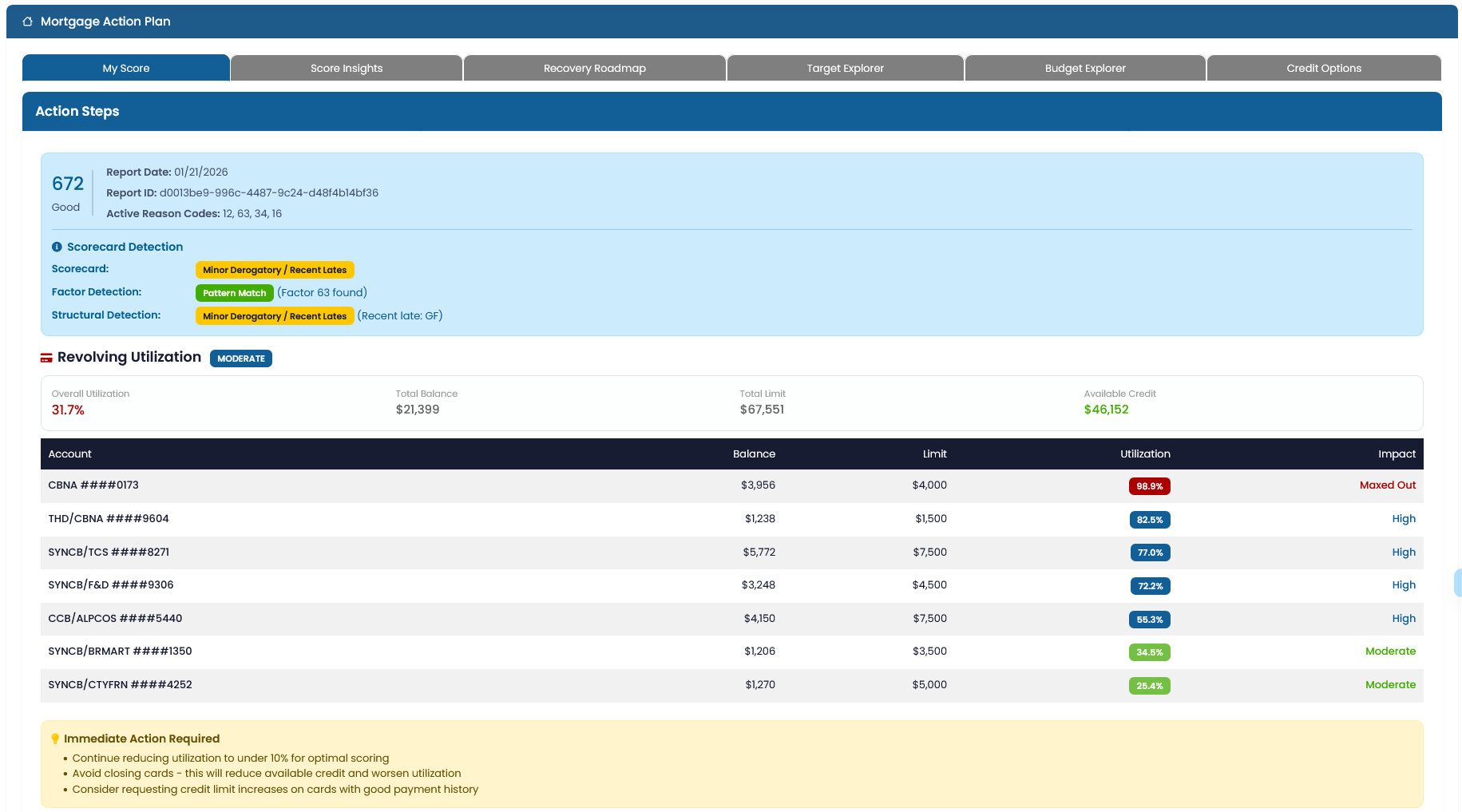

Your complete credit score overview at a glance. See your scores from all three bureaus and understand where you stand in your mortgage journey.

Your My Score dashboard gives you immediate visibility into your credit standing across all three major bureaus. No more guessing where you stand.

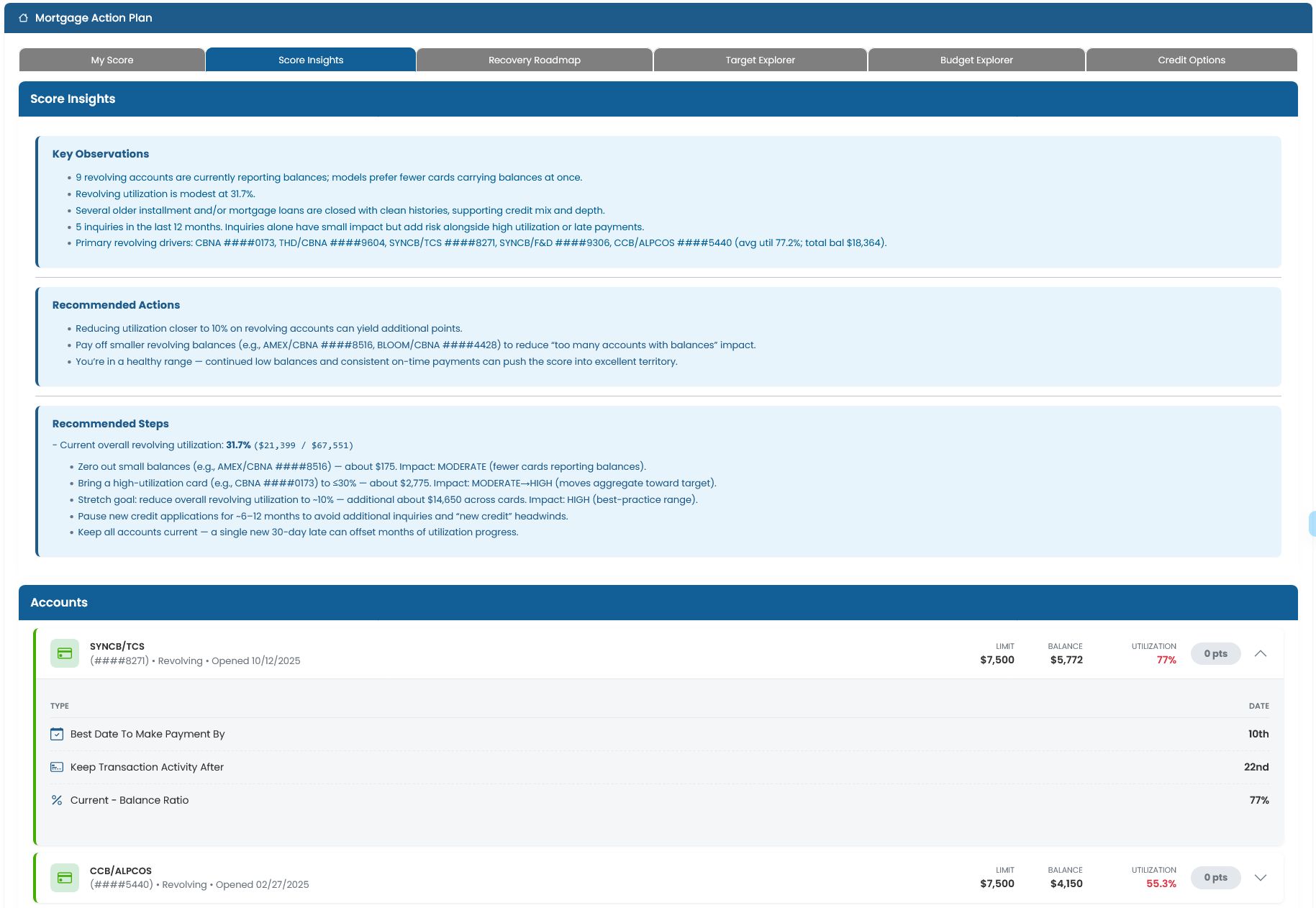

Understand exactly what's impacting your credit score. Get clear explanations and actionable insights specific to your credit profile.

Stop wondering why your score is what it is. Score Insights breaks down the factors affecting your credit in plain English with specific recommendations.

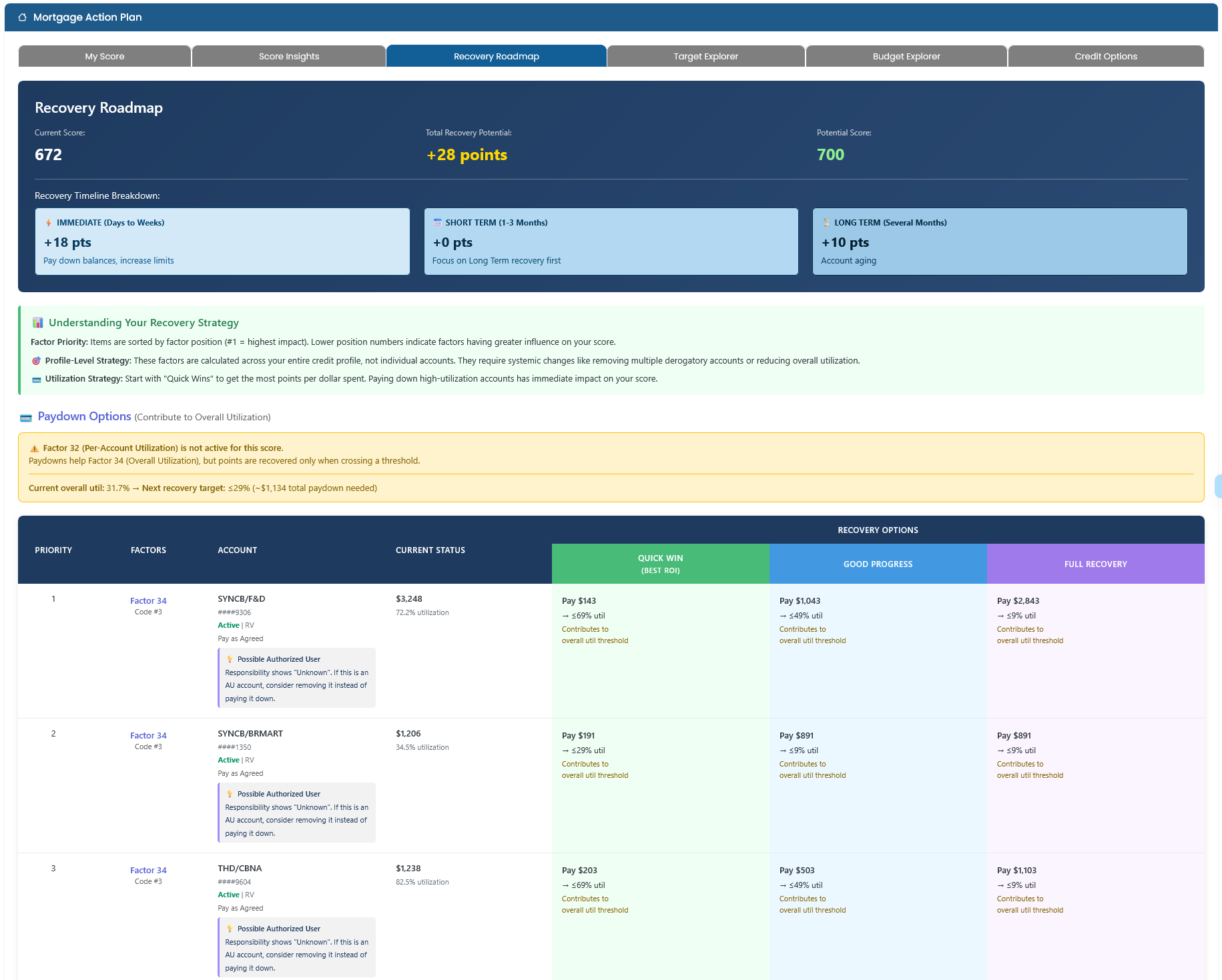

Your step-by-step guide to mortgage-ready credit. Follow a clear path with specific actions tailored to your unique credit situation.

The Recovery Roadmap analyzes your complete credit profile and creates a customized action plan. See exactly what to do, in what order, and how much impact each action will have.

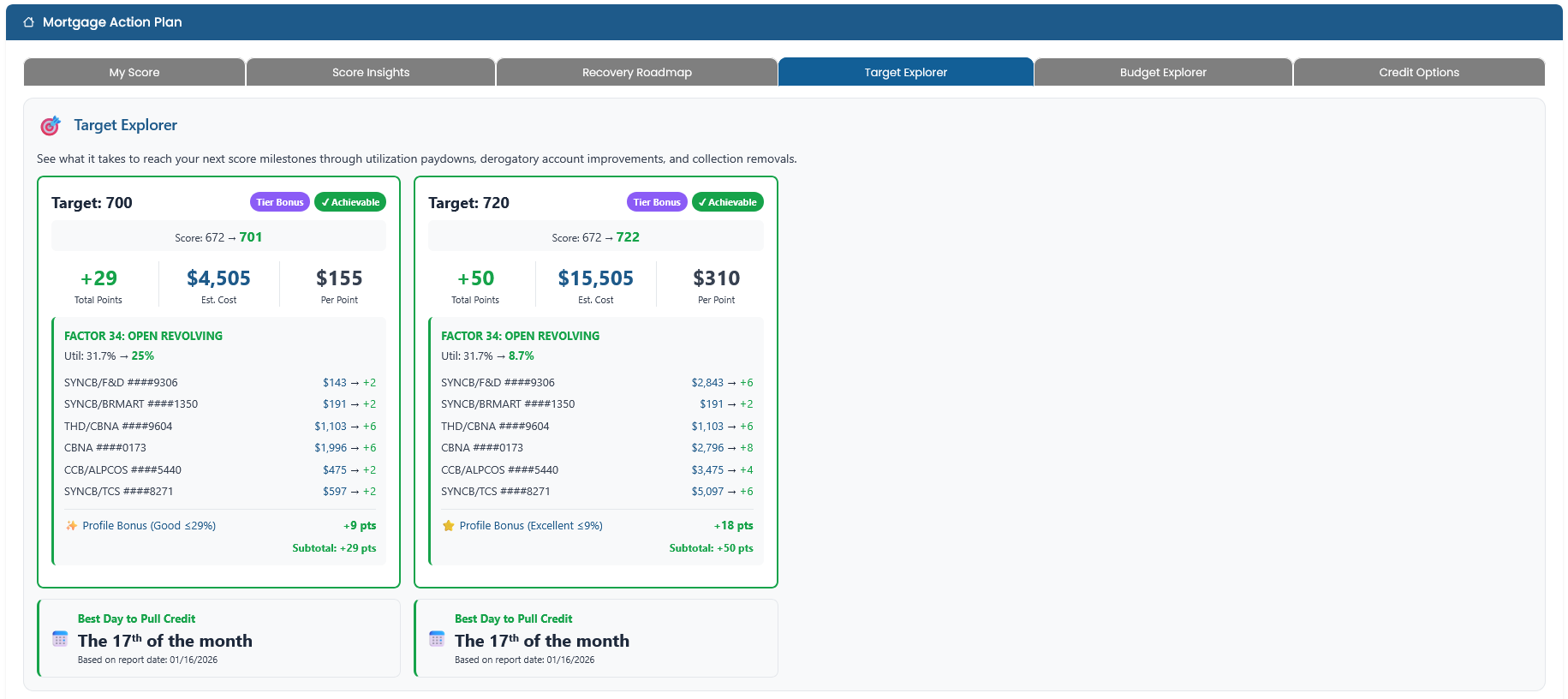

Set your target score and discover exactly what it takes to get there. Perfect for planning your path to mortgage qualification.

Target Explorer lets you set any credit score goal and instantly see what actions will get you there. Adjust your target and see different scenarios in real time.

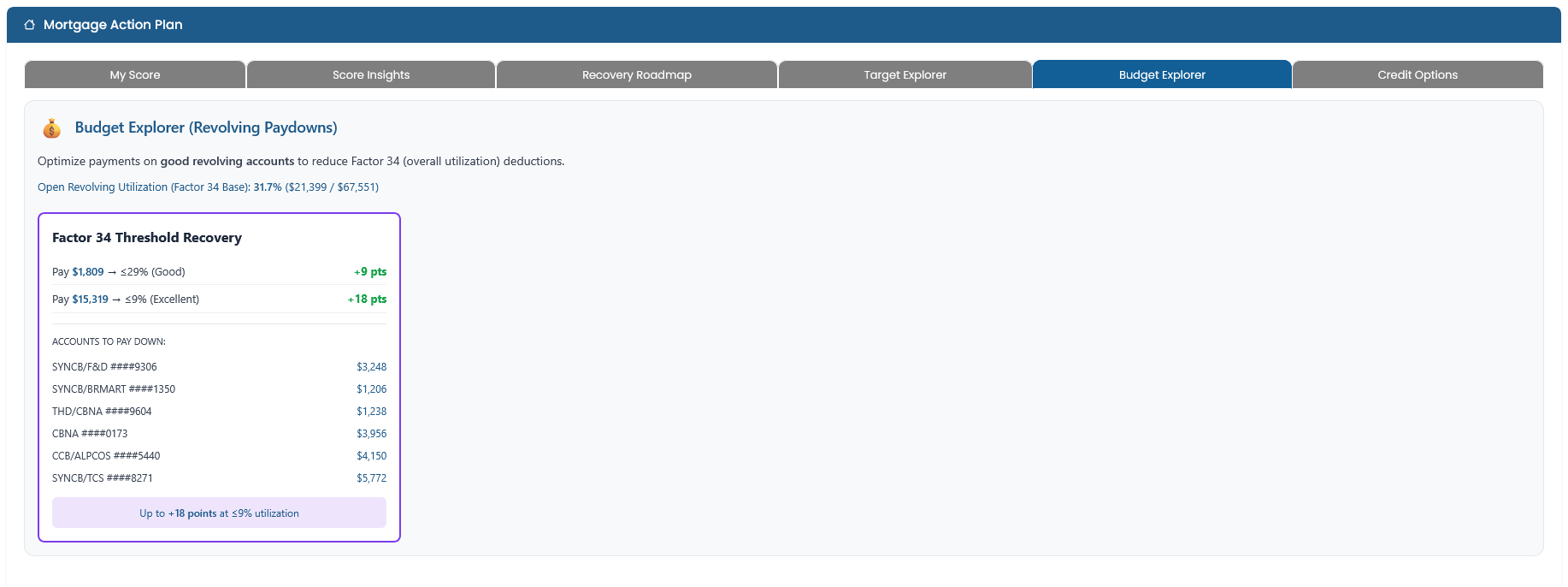

Tell us your budget and we'll show you the how to maximize your score. Make the most of every dollar you have available.

Budget Explorer analyzes all your accounts to find the optimal way to allocate your available funds. See exactly where to pay and how much for the biggest score gains.

Get unlimited access to your complete Mortgage Action Plan™ plus credit monitoring, simulators, and financial tools.