ScoreNavigator's Mortgage Action Plan is designed to align Credit Reporting Agencies, loan officers workflows, and consumer action plans—so mortgage readiness becomes measurable and manageable.

You don't necessarily have to work hard all the time. Instead, work smart. By being financially and credit savvy, you can:

The sky's the limit! It all starts with you and it starts now!

677

$400

We'll help you identify the accounts that are hurting you, and then guide you on how to get those points back!

While having good intentions or big dreams is great, it isn't enough. To fully realize your vision for your life, you should map out a plan to make that happen. This includes setting credit goals that support your values and priorities.

Your financial goals need to be meaningful, relevant and aligned with your values. To stay on track with your financial targets, you'll also want to create both short-term and long-term goals. Short-term financial goals are easier to achieve. They can help you reach your long-term goals.

ScoreNavigator has everything you need to make sense of and improve your financial standing. From credit score report services and Point Deduction Technology® to personalized financial calculators and professional advice, we have it all. Enroll today to get all the benefits!

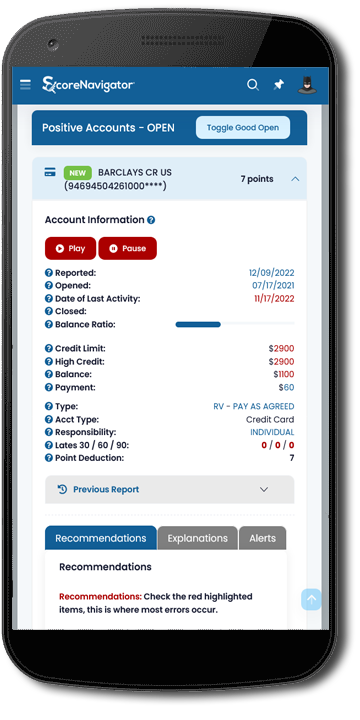

Easy-to-read, organized credit data which includes your Point Deductions (the amount of points you are losing per account).

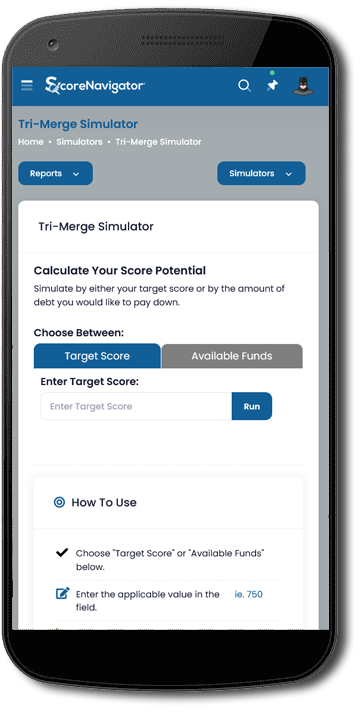

Our 3 powerful simulators will generate a plan for you on how to get your points back and how certain actions will affect your scores.

Know exactly when to pay your credit cards, when to charge them, what balances to keep them under, and changes in your balance ratio.

Having healthy budgeting habits is the prerequisite to credit success. Plug in your income and expenses, and see where you can make the necessary changes.

Pay off your car, credit cards, and loans strategically by using that pay off calculators located inside of ScoreNavigator.

Without proper education, what do you do? With ScoreNavigaator, learn about financial and credit concepts as you navigate your journey.

We are an A+ Accredited BBB technology company that aims to help consumers accomplish their goals by providing them with simple and effective credit & financial solutions. Our Point Deduction Technology helps you identify which accounts are hurting you the most!

No matter how many times you learn about the different factors affecting your credit scores, it still feels impossible to get a grip of what's going on. ScoreNavigator demystifies the causes of credit scores through Credit Monitoring Services and Coaching Solutions.

Start working with ScoreNavigator that can provide everything you need to generate awareness, drive traffic, connect.

Complete tradeline details with your score organized by positive and negative accounts.

Simplify the impact of key decisions on your credit score with an easy-to-understand, point-based system.

ScoreNavigator offers a plan of action, including short and long term actions for maximizing your score potential.

Credit Changes, such as account balance and status changes are detailed out in the ScoreNavigator Report.

Up to four positive and negative credit factors with explanations and instructions are included.

Make notations on your accounts that you feel are being reported incorrectly for easy follow-up.

A detailed Credit Summary of your overall credit profile in easy to understand fashion.

Account specific alerts, such as the best time of the month to make your payment, and best balance to credit limit ratios.

Detailed account specific recommendations to address various real life experiences.

Click to play audio explaining your tradeline, and recommendations, all available as part of your membership.

We've helped countless individuals reclaim their financial independence by demystifying credit scores, showing them what impacts their score, and developing actionable strategies for improvement. Look at what they have to say about working with ScoreNavigator.

Since 2009, Homes for Heroes, Inc., has helped over 63,000 heroes save over $122 million on their real estate transactions, sold over $17 billion in real estate to heroes, actively partnered with more than 4,300 like-minded real estate and mortgage professionals who’ve joined in the mission, and donated over $1.4 million to heroes in need through the Homes for Heroes Foundation.

This achievement indicates that our handling and processing of customers' data meets key security standards. The protection of customer data is the highest priority for our team and we're committed to building a robust security & compliance program. We're thrilled to celebrate this milestone as another way of building trust with our customers.

We partnered with Vanta & Advantage Partners to seamlessly guide us through the compliance process.

"Faith, Family and Finance" is an inspiring and practical guide to achieving financial stability and success through the lens of faith and family values.

With forty years of experience in financial planning and counseling, This book offers its readers practical advice on budgeting, saving, investing, and managing debt, while also exploring the deeper spiritual and emotional aspects of money and its role in our lives. Through personal anecdotes and insightful reflections, this book shows how aligning our financial goals with our faith and family values can bring greater meaning and purpose to our lives, as well as greater financial security.

Whether you are struggling to make ends meet or simply looking for ways to enhance your financial well-being, "Faith, Family and Finance" offers a wealth of practical tools, tips, and strategies to help you achieve your financial goals while remaining true to your values and priorities. With its clear, engaging style and heartfelt message, this book is sure to become a treasured resource for anyone seeking financial freedom and a deeper connection to their faith and family.

New This Year - 15 winners!

In an era where financial independence and literacy are pivotal, many young individuals find themselves navigating through a maze of financial decisions without a compass. Recognizing this critical gap, The Scorenavigator Financial Literacy Scholarship Fund proudly announces its 4th Annual Scholarship initiative, dedicated to empowering the next generation with the financial acumen necessary for a prosperous future.

This year, we continue our commitment to support high school juniors and seniors from low-income backgrounds who demonstrate academic excellence with a GPA of 3.0 or higher. Our scholarship aims not just to alleviate the burden of educational expenses but to invest in the financial education of our youth, ensuring they are equipped with the knowledge to make informed financial decisions.